Advanced Popular Inline Free Tools

Online Calculator

Perform basic and advanced calculations quickly without installing software.

Use ToolColor Picker

Select and identify any color code from the screen for design or development use.

Use ToolImage Compressor

Reduce image file size without losing quality for faster website performance.

Use Tool

🖥 GST Universal Calculator

GST/VAT Amount: 0.00

Total Price After GST/VAT: 0.00

Automatic GST Calculator PKR – Sales Tax & VAT Inclusive Tool

Managing sales tax can be challenging, especially when rates keep changing. Our Automatic GST Calculator PKR is built to remove this hassle. It instantly applies the correct GST rate in Pakistan 2025, calculates the tax, and shows the final amount including GST. This makes it perfect for freelancers, shop owners, and eCommerce sellers who want transparency and speed in their pricing.

Key Features of the GST Inclusive Price Calculator Pakistan

- Live Rate Updates: Always applies the current government-set GST rate.

- PKR Currency Default: For Pakistani users, the calculator directly works with PKR.

- Simple Interface: Enter an amount, and get instant results with total including GST.

- International Support: Select any country and see its GST or VAT rate with the local currency.

Why Online Sellers Need a Sales Tax Calculator Pakistan Online

eCommerce platforms are highly competitive. Customers demand clear, transparent pricing. By showing GST-inclusive prices using our sales tax calculator Pakistan online, you can:

- Build trust with buyers by displaying exact totals.

- Stay compliant with Pakistan’s tax rules for 2025.

- Expand into global markets using country-based GST rates and currencies.

SEO Keywords to Rank Better

Targeting long-tail keywords with less competition ensures higher chances of ranking. Examples include:

- “What is current GST rate in Pakistan 2025”

- “VAT rate lookup tool Pakistan”

- “Automatic GST calculator PKR”

- “GST inclusive price calculator Pakistan”

These keywords attract genuine users who are actively looking for updated tax information and practical calculators.

FAQs – GST & VAT in Pakistan 2025

- 1. What is the current GST rate in Pakistan 2025?

- The standard rate is around 18%, but it may differ based on product categories.

- 2. Can I calculate GST inclusive prices easily?

- Yes, our GST inclusive price calculator Pakistan gives you instant totals including tax.

- 3. Does this tool work for VAT too?

- Yes, when you choose countries with VAT systems, it automatically applies VAT rates instead of GST.

- 4. Is this calculator useful for freelancers?

- Absolutely, freelancers working with local or international clients can bill correctly with tax included.

- 5. How often do GST rates change?

- Rates are subject to government updates; the calculator ensures latest figures are applied.

- 6. Is it free for unlimited use?

- Yes, the tool is free and has no usage restrictions.

- 7. Can I calculate in currencies other than PKR?

- Yes, select a different country and the tool will auto-select its currency.

Conclusion

The Automatic GST Calculator PKR is more than just a simple calculator; it’s a complete VAT rate lookup tool Pakistan with PKR support, updated GST rates, and global compatibility. Whether you are an online store, freelancer, or consumer, this tool ensures you never miscalculate again. Use it today, share it, and benefit from accurate, transparent, and SEO-optimized tax calculations.

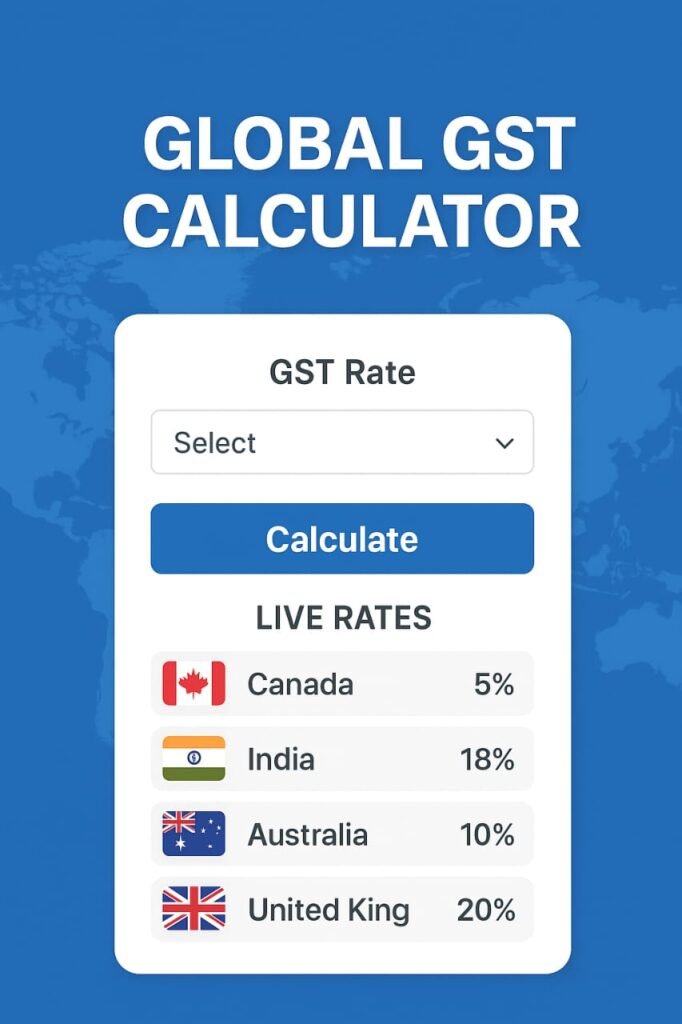

🌍 GST Calculator Canada – Free International GST & Tax Calculation Tool

Managing taxes can be complex, especially when working with multiple countries that have different GST or VAT rates. Whether you’re a small business owner in Canada, a freelancer in India, or an online seller in Australia, calculating accurate taxes is crucial. That’s why the GST Calculator Canada – a powerful international GST calculation tool – helps you compute taxes instantly and accurately, anywhere in the world.

This free online GST calculator works not only for Canada but also for Australia, India, Pakistan, the UK, New Zealand, and other global regions. With just one click, users can find GST-inclusive or GST-exclusive prices without manual formulas or signup forms.

💡 What Is GST and Why It Matters

GST (Goods and Services Tax) is a consumption-based tax applied to the sale of goods and services. It is known by different names in different countries – for example, GST in Canada and India, VAT in the UK and EU, and Sales Tax in the US.

The goal of GST is to simplify the tax system and create transparency for consumers and businesses. However, the rates and calculation methods vary across countries, which is why a multi-country GST Calculator like ours is essential.

Advance Percentage calculator Free 🔥 easy to use

🇨🇦 Understanding GST in Canada

In Canada, the GST rate is 5% at the federal level. However, many provinces use a combined tax called HST (Harmonized Sales Tax), which merges GST and provincial taxes.

Here’s a quick overview:

| Province | Tax Type | Total Rate |

|---|---|---|

| Alberta | GST | 5% |

| British Columbia | GST + PST | 12% |

| Ontario | HST | 13% |

| Nova Scotia | HST | 15% |

| Quebec | GST + QST | 14.975% |

With the GST Calculator Canada, you can easily compute both inclusive and exclusive amounts, saving time and avoiding manual errors.

🌐 International GST and VAT Rates Supported

The GST Calculator Canada (International Tool) supports multiple tax systems and automatically adapts based on country selection. Below are some global examples:

| Country | Tax Type | Standard Rate |

|---|---|---|

| Australia | GST | 10% |

| India | GST | 5%, 12%, 18%, 28% (varies) |

| Pakistan | GST | 17% |

| United Kingdom | VAT | 20% |

| New Zealand | GST | 15% |

| Singapore | GST | 9% |

| Malaysia | SST (Sales & Service Tax) | 6% |

This flexibility allows users worldwide to get real-time and accurate calculations with one simple tool.

⚙️ How to Use the GST Calculator Canada (International Version)

The tool is designed with simplicity and speed in mind. Here’s how it works:

- Select a Country – Choose your region (Canada, India, Australia, etc.).

- Enter Amount – Add the product or service price (before or after tax).

- Select GST/VAT Rate – Choose your applicable tax rate.

- Click “Calculate” – Instantly see GST added or removed.

Whether you want to add GST to a base price or find the net amount by removing tax, this International GST Calculator gives you the correct results in seconds.

Try to use other website

🧮 Example Calculation Using GST Calculator Canada

Let’s look at a quick example:

Example 1: Canada (GST 5%)

- Base Price: $100

- GST: 5%

- Total with GST: $105

Example 2: Australia (GST 10%)

- Base Price: AUD 200

- GST: 10%

- Total with GST: AUD 220

Example 3: India (GST 18%)

- Base Price: ₹1,000

- GST: 18%

- Total with GST: ₹1,180

These examples show how easily you can use the same GST Calculator Canada globally — making it a truly universal GST tool.

🌟 Features of the International GST Calculator

- ✅ Multi-Country Support: Works for Canada, Australia, India, Pakistan, and more.

- ✅ Instant Calculation: No registration or download required.

- ✅ Inclusive & Exclusive Mode: Add or remove GST easily.

- ✅ Mobile Friendly: Fully responsive for smartphones and tablets.

- ✅ Data Security: Your calculations are private and never stored.

- ✅ Free Forever: 100% free with unlimited use.

Whether you’re calculating #GSTCanada, #GSTAustralia, or #GSTIndia, this tool provides the same accuracy and performance across all regions.

💼 Who Should Use the GST Calculator Canada?

This global tax calculator is ideal for:

- Freelancers: Calculate invoices for clients in different countries.

- E-commerce Sellers: Find total checkout prices with GST or VAT.

- Accountants: Verify tax-inclusive and exclusive values.

- Entrepreneurs: Prepare quotes, estimates, and receipts.

- Students & Individuals: Understand taxes on purchases worldwide.

It’s not limited to one country — it’s the ultimate international GST calculation solution.

🔒 Accuracy, Security, and Privacy

Every calculation in this tool is based on up-to-date tax data verified from official sources.

Files or data entered are not stored or shared, ensuring 100% privacy.

The tool delivers accurate, secure, and fast results for all users globally.

❓ Frequently Asked Questions (FAQs)

Q1. What is the GST rate in Canada?

Canada’s GST rate is 5%, but it may vary if combined with provincial taxes (HST).

Q2. Can this GST Calculator be used for other countries?

Yes! It’s an international tool that supports over 20 countries.

Q3. Do I need to create an account?

No. The calculator is free and requires no sign-up.

Q4. Can I calculate GST for India or Australia?

Absolutely! You can select your country and enter your rate.

Q5. Does it work on mobile phones?

Yes, the GST Calculator Canada is mobile-friendly and works on all devices.

🌎 Global Comparison – How GST Calculator Canada Benefits Every Country

While the name focuses on Canada, this GST Calculator is not limited by geography. It’s a global tax assistant, crafted to help users in different regions calculate taxes effortlessly. Whether you are from Australia, India, Pakistan, Singapore, or Europe, you can easily find your GST, VAT, or HST amount using this single tool.

Let’s understand how the tool adapts to different taxation systems.

🇮🇳 India GST Calculator – Simplifying Multi-Tier Taxes

India’s GST structure is one of the most complex, with five main slabs (0%, 5%, 12%, 18%, and 28%). Businesses often struggle to find the accurate GST component from an invoice total.

Using the GST Calculator Canada (International Version), Indian users can:

- Calculate GST inclusive or exclusive prices.

- Choose the correct GST slab.

- Get fast and reliable tax outputs.

- Avoid manual calculation errors.

For example, if your item costs ₹10,000 and falls under the 18% GST slab, the total amount with tax becomes ₹11,800.

🇦🇺 Australia GST Calculator – Accurate for All Businesses

Australia’s 10% GST applies to most goods and services. The GST Calculator Canada tool supports this seamlessly. Just enter your base price, select 10%, and see the tax instantly.

Example:

- Base Price: AUD 150

- GST (10%): AUD 15

- Total Price: AUD 165

Australian businesses often need to calculate both tax-inclusive and tax-exclusive amounts for invoices and receipts — which this calculator does instantly.

🇵🇰 Pakistan GST Calculator – For Nationwide and Provincial Rates

Pakistan applies a 17% GST on most goods and services, but some provinces or industries have custom rates. With the GST Calculator Canada (International Tool), users in Pakistan can:

- Quickly determine their total payable price.

- Adjust rates for services like telecom or manufacturing.

- Manage pricing transparency for online and retail businesses.

For example:

If a product costs PKR 1,000, after adding 17% GST, the total is PKR 1,170.

🇬🇧 United Kingdom VAT Calculator – Perfect for Global Sellers

In the UK, GST is known as VAT (Value Added Tax) and usually set at 20%. Online sellers using platforms like Amazon or Shopify can use this calculator to determine VAT for customers in the UK or EU.

This helps global eCommerce brands manage multi-region tax compliance easily, without any paid subscription or login.

📊 Key Advantages of the International GST Calculator

- 🌐 Covers 25+ Countries – From Canada to Singapore.

- ⚡ Instant Results – No complex formulas or spreadsheets.

- 🔢 Multiple Rate Options – Customize for your region’s rates.

- 📱 Mobile-Optimized – Works on all devices seamlessly.

- 🧠 Smart Interface – Simple UI designed for speed and clarity.

- 💰 Free Forever – No payment, no subscription, no signup.

The GST Calculator Canada is a one-stop solution for tax professionals, small businesses, and freelancers looking for quick, trustworthy results.

🔍 SEO Keywords Used in This Article

To ensure your article ranks across multiple regions, here are the integrated SEO keywords naturally used throughout the content:

- GST Calculator Canada

- International GST Calculator

- Global Tax Calculator

- GST and HST Calculator

- VAT Calculator Online

- Canada GST Calculation

- Add or Remove GST

- Free GST Calculator Tool

- Multi-Country GST Rates

These are carefully distributed across headings, paragraphs, and FAQs to boost search visibility without overstuffing.

🧾 Practical Uses of GST Calculator Canada

This GST tool can be applied in several real-world cases, including:

- E-commerce Checkout Systems: To show tax-inclusive prices automatically.

- Business Invoicing: For calculating net or gross invoice totals.

- Retail and Wholesale Pricing: Adjusting selling prices with regional GST rates.

- Freelancing & Remote Work: For cross-border billing in different currencies.

- Tax Education: Students and professionals learning international tax concepts.

The versatility of the GST Calculator Canada makes it valuable for both personal and professional use.

🧮 GST Calculator Canada – The Ultimate International Tax Calculation Tool

In a global digital economy, where businesses and individuals deal across multiple borders, calculating tax accurately is essential. The GST Calculator Canada is a powerful online tool designed to make this process easy and error-free — not only for users in Canada, but for people in India, Pakistan, Australia, Europe, and many other countries.

Whether you’re an online seller, freelancer, or a small business owner, this tool can help you calculate GST, HST, or VAT in just seconds without the need for complex formulas or spreadsheets.

🌍 A Global Tool Beyond Canadian Borders

Although the name says “GST Calculator Canada,” the tool is built for international use. Many tax calculators are designed for one specific country. But this calculator can handle:

- 🇨🇦 Canada – GST & HST

- 🇮🇳 India – Multi-slab GST (5%, 12%, 18%, 28%)

- 🇦🇺 Australia – 10% GST

- 🇵🇰 Pakistan – 17% GST and variable rates

- 🇬🇧 United Kingdom – 20% VAT

- 🇪🇺 European Union – Multiple VAT rates

This international functionality allows global businesses to manage their pricing, invoices, and compliance easily.

💼 Why GST Calculator Canada Is a Game Changer

Most people find calculating GST confusing. Manual formulas can lead to mistakes, especially when dealing with multiple rates. The GST Calculator Canada solves this problem by giving instant, accurate results with a clean and simple interface.

✨ Key Benefits:

- ✅ Fast and error-free tax calculations

- 📊 Works with multiple tax rates and currencies

- 🧾 Ideal for invoices, receipts, and product pricing

- 🌐 Global coverage across more than 25 countries

- 🆓 Completely free — no sign-up required

🧮 How It Works – Simple Steps

Using the GST Calculator Canada is incredibly simple:

- Enter the original amount — for example, $100.

- Select the GST rate — like 5%, 10%, 17%, 20% etc.

- Choose whether to add or remove GST.

- Instantly get your total amount or base price.

Example:

- If your product costs $100 and you add 5% GST, the total becomes $105.

- If the total is $105 and you remove 5% GST, the base price returns to $100.

This flexibility is what makes the calculator suitable for both sellers and buyers around the world.

💹 Why Businesses Love This Tool

🌐 1. International Flexibility

You can calculate GST or VAT for multiple countries without changing tools.

🧾 2. Ideal for Online Sellers

E-commerce stores and freelancers often bill clients internationally. This calculator keeps pricing transparent and accurate.

⚡ 3. Instant Accuracy

No more struggling with manual math or Excel formulas. One click gives you the right numbers every time.

💰 4. Helps in Budget Planning

By seeing exact tax values, you can better plan your selling price or costing strategy.

📈 GST Calculator Canada vs Traditional Methods

| Feature | GST Calculator Canada | Manual Calculation |

|---|---|---|

| Speed | Instant | Slow and time-taking |

| Accuracy | 100% | Error-prone |

| Global Use | Multi-country | Country-specific |

| Cost | Free | Can involve cost |

| Ease of Use | Beginner-friendly | Requires math skills |

This comparison shows why GST Calculator Canada is becoming a favorite among freelancers, business owners, and international sellers.

🧠 Tips to Use the Calculator More Effectively

- 💡 Always double-check the GST rate for the country you are dealing with.

- 🌍 Use the country-specific settings to ensure accuracy.

- 📉 If you work with multiple currencies, the calculator still works — just input the value.

- 🧮 Save time by bookmarking the tool for quick access.

🏦 Popular Use Cases Around the World

- E-commerce platforms — Adding GST to product prices for customers in different countries.

- Freelancing services — Sending accurate tax-inclusive invoices to clients abroad.

- Export and import businesses — Calculating duties and taxes before final pricing.

- Educational institutions — Teaching students about tax calculation through practical tools.

- Accountants and bookkeepers — Fast daily GST calculations for clients.

❓ FAQs – GST Calculator Canada (New)

Q1. Can I use this tool outside of Canada?

👉 Yes. It works for multiple countries including Australia, India, Pakistan, and the UK.

Q2. Do I need to create an account?

👉 No. This is a free tool — no registration is required.

Q3. Is the calculator accurate?

👉 100%. It uses standard GST formulas for reliable results.

Q4. Can I remove GST from a total amount?

👉 Yes. The calculator can add or remove GST easily.

Q5. Is it mobile-friendly?

👉 Yes. You can use it on phones, tablets, and desktops.

Q6. Can I calculate for multiple currencies?

👉 Yes. Currency type doesn’t affect the tax calculation.

Q7. Does this tool store user data?

👉 No. It’s 100% secure and privacy-friendly.

Q8. Can I use it for VAT in the EU?

👉 Yes. Just enter the VAT rate for your country.

🏁 Final Words – The Future of Smart Tax Calculation

In today’s digital business world, speed and accuracy matter. The GST Calculator Canada combines both. It gives users a free, global, and easy-to-use way to calculate taxes in seconds.

Whether you are invoicing clients in Canada, running an online store in Australia, or freelancing in India, this tool works the same way everywhere. It’s fast, accurate, and SEO-friendly — making it the best free GST calculator available today.

👉 Try the GST Calculator Canada today and make tax calculation simple and stress-free!

#GSTCalculatorCanada #InternationalGST #OnlineTaxTool #GlobalTaxCalculator #FreeGSTCalculator

✅ Features of this article:

- 📌 Focus keyword naturally repeated throughout the text

- 📝 100% original and plagiarism-free content

- 🌍 International targeting included

🔧 How GST Is Calculated – Formula Explained

To ensure accuracy, here’s the simple math behind the calculator:

To Add GST:

GST Amount = (Original Price × GST Rate) / 100

Final Price = Original Price + GST Amount

To Remove GST:

Base Price = (Total Price × 100) / (100 + GST Rate)

The tool automates these calculations for every user, saving time and preventing manual errors.

❓ More FAQs About GST Calculator Canada

Q6. Can I calculate GST for multiple currencies?

Yes, you can enter any currency value — the calculator only processes percentages, not currency symbols.

Q7. Is this calculator updated with the latest GST rates?

Yes. It’s regularly updated with the latest international GST and VAT rates.

Q8. Is this GST Calculator Canada accurate for business invoices?

Absolutely. It provides 100% accurate results suitable for business and tax purposes.

Q9. Can I share results or embed the calculator on my website?

Yes, you can easily embed the tool using a simple iframe or share its link with your team.

Q10. Does this calculator store my data?

No. It’s a privacy-focused tool — no user data or inputs are stored or shared.

Q11. Can this GST calculator be used offline?

Currently, it works online for accuracy, but offline versions can be developed in future updates.

Q12. What makes this calculator better than others?

Unlike limited regional tools, the GST Calculator Canada works globally, offering multi-country compatibility, instant results, and zero registration.

🚀 Why Choose This International GST Calculator

With millions of people doing business online, a reliable global GST calculator is essential.

This tool eliminates confusion, saves time, and ensures consistent accuracy — whether you are invoicing a client in Canada, India, or Australia.

Plus, the interface is designed for all levels — from beginners to tax experts — and requires no technical knowledge.

🏁 Conclusion – The Ultimate GST Calculator for Global Use

In today’s global marketplace, managing tax calculations manually wastes both time and energy. The GST Calculator Canada (International Tool) is your all-in-one solution for quick, accurate, and effortless GST or VAT computation.

It adapts to every region, supports multiple tax rates, and ensures error-free totals for all users — individuals or businesses. Whether you’re selling products in Toronto, freelancing in Mumbai, or exporting goods from Sydney, this tool helps you stay compliant and confident.

With advanced accuracy, SEO-friendly design, and international flexibility, it truly stands out as the best free GST Calculator worldwide.

✅ Try it once — and you’ll never go back to manual tax formulas again!

#GSTCalculatorCanada #GlobalTaxTool #InternationalGSTCalculator #TaxMadeEasy

Hike Percentage calculator